Anti-digital, pro-realty sector budget

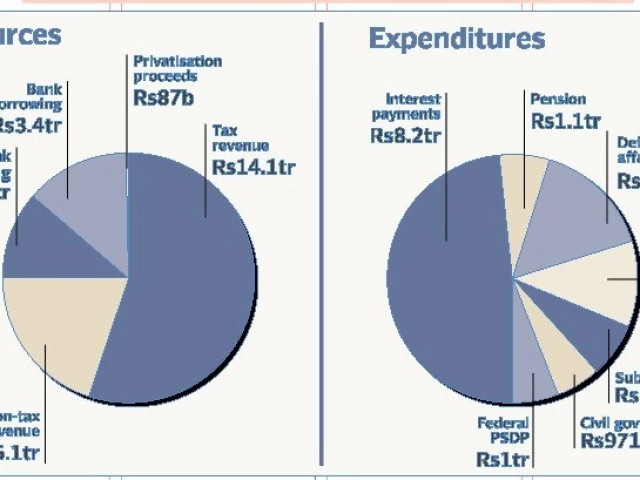

ISLAMABAD:Finance Minister Muhammad Aurangzeb on Tuesday unveiled a Rs17.6 trillion budget, which attempted to limit fiscal expansion but taxation measures were clearly self-contradictory that on one hand would promote cash economy and fossil fuels but discourage these too on the other.

The government of Prime Minister Shehbaz Sharif also introduced new taxes on the digital economy, pensioners and clean energy. Some of these measures were contradictory to the stated policy to discourage the cash economy.

However, the Finance Bill 2025-26, also gave incentives for clean energy by taxing the internal combustion engine cars and fossil fuels.

Despite high poverty and high unemployment, the government proposed to drastically reduce import duties from raw materials to finished goods, which the industry feared would lead to de-industrialisation of Pakistan.

The economy has been opened for the foreign competition by lowering protection available to local industries. The finance minister said that the maximum custom duty slab has been reduced to 15% while a five-year plan had been given to abolish additional and regulatory duties.

The inaudible budget speech, which Aurangzeb, delivered in the midst of rowdy opposition, clearly lacked in giving any policy direction.

While the Finance Division tried to meet the International Monetary Fund’s (IMF) requirement to meet fiscal targets, the Federal Board of Revenue (FBR) was not able to come up with the clear taxation policy.

The Finance Bill 2025-26 appeared to be the most confusing document that any government produced in years. It revolved around going after the economy of the youth and the 21st century business practices.

The government has proposed 18% sales tax on import of solar panels but it imposed Rs2.5 per litre carbon levy on use of petrol, diesel and furnace oil, showing the lack of clarity on the part of the government.

Likewise, it increased the tax on cash withdrawals from banks from 0.6% to 0.8% to discourage cash economy and generate more easy money but it also imposed a new tax on digital services platforms in the range of 0.25% to 5%.

The government also increased sales tax on 850 cc cars of the middle class from 12.5% to 18%. A new tax has been introduced on pensioners where the monthly pension of Rs833,000 has been taxed at the rate of 5%.

The FBR was once again lacking in determining the policy, whether the government wanted to promote digital economy or cash economy. FBR Chairman Rashid Langrial cancelled the media briefing on the Finance Bill 2025-26, which was tantamount to compromising transparency and the right of the people to know about the measures that impact their futures.

In his budget speech, the finance minister surprisingly stated that the “rapid growth in the online business and digital market places was creating problems for traditional businesses, therefore, it is proposed that e-commerce platforms, couriers and logistic services should be taxed at the rate of 18%.

A tax official told The Express Tribune that the FBR would earn Rs64 billion by taxing the digital economy. The Finance Bill 2025-26 showed that the economic managers preferred the 19th century economy by providing some relief on purchase of properties but taxed the digital platforms of the 21st century.

It has also proposed to ban economic transactions of ineligible persons, which include ban on purchase of properties, cars and investment in securities by persons whose assets do not match these purchases.

Through the Finance Bill, the government also amended a host of other non-tax laws besides introducing two new legislations, the Digital Presence Proceeds Act 2025 and the New Energy Vehicles Adoption Levy Act, 2025. There might be constitutional questions, whether the new laws can be introduced through the Finance Bill.

The government has proposed a total of over Rs415 billion worth of tax measures in the budget, said the senior tax official. These include Rs292 billion worth of FBR-related measures, Rs111 billion additional earnings by imposing Rs2.5 per litre carbon levy on petrol, diesel and furnace oil and Rs9 billion worth levy on conventional cars.

Finance Minister Aurangzeb said that the IMF had also accepted the Rs389 billion worth enforcement measures. But he admitted that the FBR’s tax-to-GDP ratio would remain below the IMF target of 10.6% in this fiscal year.